Dunnes Hold Number 1

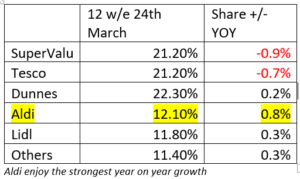

The latest Kantar market share data for 12 w/e 24th March 2019 places Dunnes stores in number one position with 22.3%. Tesco and SuperValu are joint second with 21.2%. Aldi and Lidl are 4th and 5th with 12.1% and 11.8% market share respectively. Dunnes are the only multiple retailer growing share year on year, partly thanks to the €10 off €50 mechanic. They released a free €10 ‘starter voucher’ via the Sunday Independent, valid from 3rd to 9th March, giving share in this period a boost.

Congestion in Q1

Congestion in Q1

The first 12 weeks of this year are as congested as they possibly could be. The latest Kantar data is a measure of performance over a significant number of mini events and this data captures shopping trends from 31st December 2018 right up until 24th March 2019. In that time period we had eight distinct trading events that benefited a wide variety of categories:

- New Year’s Eve 31st Dec (alcohol)

- New Year healthy eating from January 1st (fruit & veg, lean protein, free-from foods)

- Valentine’s Day (14th Feb: flowers, cards, chocolate, bubbly, gifts)

- Pancake Tuesday 5th March (flour, eggs, Nutella, pancake pre-mixes)

- Ash Wednesday 6th March (fish)

- St Patricks Day 17th March (produce, horti, meat, alcohol, non-food ‘partyware’)

- Spring Clean / Spring Gardening (household, DIY, gardening, garden furniture, horti)

- Easter lead-in (confectionery)

None of these events require significantly expansive ranges or in-store space commitments. Rather, a retailer’s success in this period is more linked to its ability to curate an evocative, limited range offer which is then communicated effectively through integrated marketing. This is ideal territory for discounters who are well used to turning over from one theme to another every week and communicating it in the weekly leaflet. This partly explains their continued good performance. But it also partly explains the weaker performance from Tesco and SuperValu. The same 12wk period in 2018 included one of the Easter lead-in weeks, with Easter landing 3 weeks earlier last year. We know that the multiples are especially strong during big events like Christmas and Easter so this will be missing from their performance this year and should correct itself at the next read.

The Beast from the East

It’s interesting to note that this 12 week period also overlaps last years big weather disruption. From around 20th February 2018, customers were panic buying staples like bread and milk. Many retailers struggled to cope, with some supplier deliveries getting into Central Distribution Depots, but very little getting out. Last year’s weather strongly benefited the retailers with the biggest networks, and most direct store deliveries via local suppliers since they enjoyed the best availability and proximity to customers. We can see it in SuperValu’s numbers this year. They are down a full 0.9% year on year and reflects the gains they made last year, rather than any major mishap this year.

Aldi on a roll

Aldi continue to perform strongly for all the reasons we’ve covered previously (re-vamped ‘project fresh’ stores, strong competitive price position, fully re-designed PL packaging range across the store, strong marketing via the ‘Swap & Save’ vehicle, great seasonal ranges and new store openings). However, this is their best period ever in Ireland, having reached 12.1% market share, an improvement of 0.8% year on year, and growing sales by 11.0%. This is a significant milestone, one that should be noted by UK retailers where Aldi have just hit 8.0%. Will they get to 13.0% this year?