Headlines

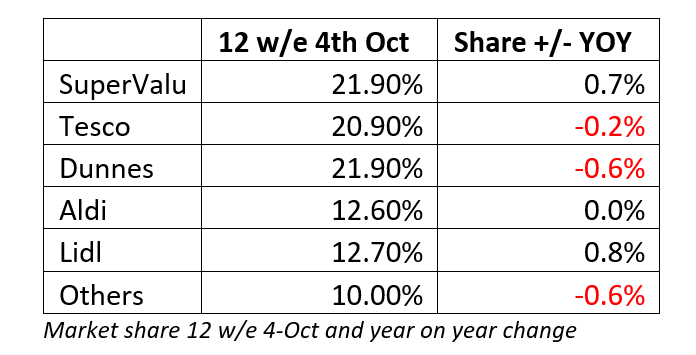

The Kantar Worldpanel data for the 12 weeks to October 6th sees SuperValu in joint 1st place with Dunnes Stores, each on 21.9% market share of the take-home grocery market. Tesco are third on 20.9%. As per last period, Lidl are fourth with 12.7% and Aldi are fifth with 12.6%. The market grew by +11.9% during this latest 12 wk period, which is considerably down on the +25% growth we saw during the mid-summer lockdown. Growth of +11.9% equates to almost €295m extra spent on groceries over the 12 weeks.

HORECA Returns (with local limitations)

The most recent Kantar data spans a 12-week period from Monday 13th July to Sunday 4th October. Yet again, it’s another fascinating period during which we can see the impact on retailer performance due to the reopening of hotels, restaurants, cafés and gastropubs from 29th June.

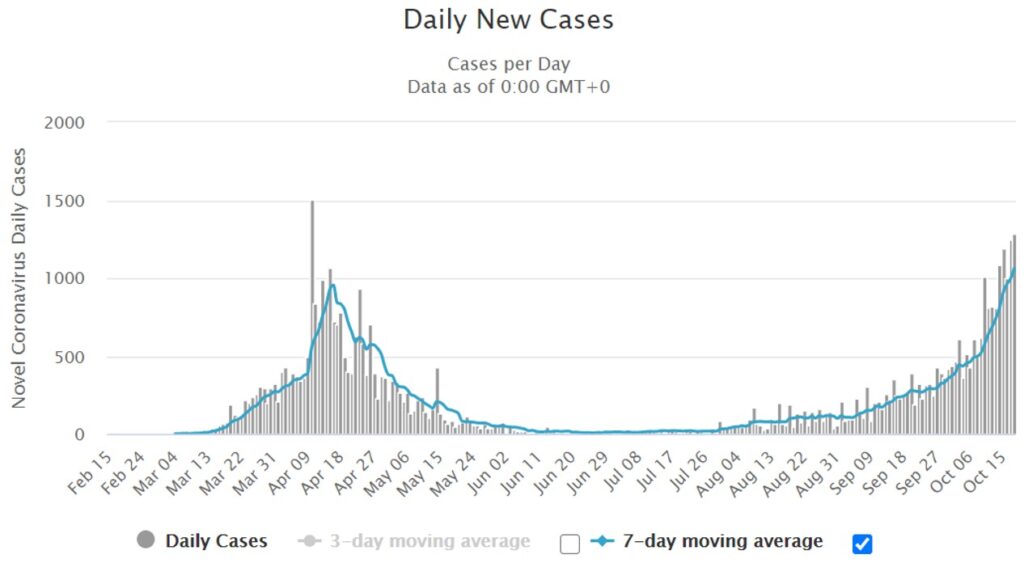

Unfortunately, we can also see the effect of rising covid case numbers. The additional restrictions in Laois, Offaly and Kildare from 7th August, and in Dublin from 18th September appear to have prompted some mild stocking up. But it was far from panic buying, and likely reflects the genuine concerns of elderly and vulnerable shoppers who would prefer to restrict their movements.

That said, for most consumers, there was still some sense of normality during this period, and a HORECA sector operating at about 50-60% of normal capacity meant that supermarket growth was running around +11 to +12% for the twelve-week period.

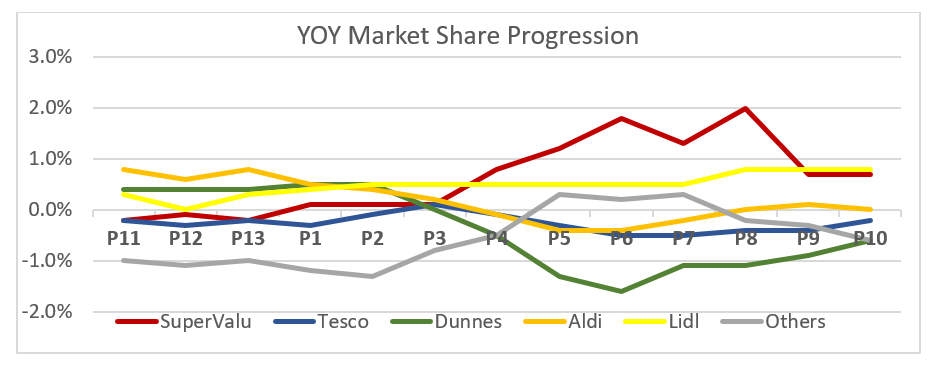

As per the last months commentary, SuperValu and Centra had been the key beneficiaries of proximity shopping, so the reverse was also true as the lockdown was unwound. Their market share has fallen from a peak of 23.3% during the lockdown and staycation period and now sits at 21.9%, joint with Dunnes Stores. The growth of online shopping declined significantly in this period, growing at ‘only’ 75% compared to previous growth at +128%. Again, since SuperValu were the big winner for online sales, and as these declined then SuperValu lost out. The Level 3 restrictions in Dublin will have yielded less benefits for SuperValu, this time benefitting Lidl and Dunnes.

Dunnes on the other hand continued to see a return to pre-covid patterns. They had previously lost out due to their lower store numbers and absence of online. But as proximity and online became less important then shoppers returned to their pre-covid habits, with a little encouragement from the August Value Club mail-out and the ever popular €10 off €50 offer.

Tesco market share performance has been quite steady throughout this turbulent year. They have the most balanced ‘omni-channel’ offer with a good balance of large footprint hypermarkets, medium sized supermarkets and urban convenience markets alongside a well-established online delivery and click & collect service. They continue to sharpen their price position, most recently dropping prices on a selection of branded items. And now, having over-lapped the Douglas Shopping Centre of 31st August 2019, their year on year decline has improved to -0.2ppts.

Like Tesco, Lidl market share has been remarkably steady through all phases of the pandemic, with their share consistently up +0.8ppts in the last few months. I’m still unclear what benefits the new Lidl Plus rewards app is delivering. On the other hand, their partnership with Buymie really is delivering. Customers can get deliveries across all of Dublin and the big commuter towns in Kildare and Wicklow. The service was extended to Cork City during August giving them at least 40% coverage of the national population.

Aldi are a little behind Lidl on their online journey, commencing their Deliveroo trial in June, but recently extending the product range from 140 to 300 products. They have certainly kept up the pace on developing their estate. The new store in Belmullet, Co Mayo, in August brought their total to 143 stores, and Rathnew made it 144 in October but it won’t have impacted these latest market share figures. They also continue to refresh their estate with the project fresh revamp landing in Newcastlewest, Navan and Arklow in the last few weeks.

As we go to print, the Government have just announced the introduction of Level 5 restrictions for a period of 6 weeks. Crucially, there is a 5km limit on non-essential travel and the hospitality sector is reduced to takeaway only. This should see the take-home grocery market return to around +20% for the period to end November. This should benefit SuperValu, but it will be interesting to see the impact of Aldi, Dunnes and Lidl either entering or stepping up their online activities this time around. Also consider the impact of queuing outdoors during in winter. This should favour Tesco who have managed to create indoor queuing systems in many locations.

Malachy O’Connor

Retail Industry Consultant & Director at Food First Consulting www.foodfirstconsulting.ie

Partner at International Private Label Consult www.iplc-europe.com