Impulse

Grocery shopping patterns have changed considerably over the past year. Prior to COVID-19, whilst many consumers did their grocery shopping on autopilot, many others actually quite enjoyed the experience. They would meander around the store taking in the sounds and smells, searching for deals, responding to promotional messages and actively checking out new products. Crucially, sometimes they would make purchasing decisions based on these stimuli. This was an ideal environment for launching new products and promoting existing ranges, prompting the impulse reactions that FMCG brands are dependent on.

But the arrival of COVID-19 has resulted in a different type of shopping experience. These days, customers are much more deliberate in how they shop. In this new era of social distancing, it can be an anxious experience that involves planning, queuing, sanitising your hands and wearing a mask. Shoppers might even need to use an app to book their slot. And once they get in-store, it is much more planned, with far less browsing, using a list and getting in and out of the supermarket as quickly and purposefully as possible.

The shoppers’ senses are bombarded by COVID messages, reminding them to keep their distance, stand here, walk there and don’t stop to chat. There is so much noise for anxious shoppers and this makes it hard for brands to stand out. Many brands have pulled their planned spend on in-store POS activations and new product launches. And retailers have universally banned tasting and sampling promotions. Most brands agree that innovation will be the key to recovering any ground lost during the pandemic. And retailers know that new products are an essential part of their margin management plan. But both retailers and suppliers have simplified their ranges, pulled back on NPD launches and reduced promotional activity, instead focusing on maximising basic range availability during these turbulent times.

The Challenge for NPD

I conducted some research with suppliers across Ireland and Europe during summer 2020 and I asked them about their intentions in relation to NPD and R&D. 69% of suppliers said that they were intending to spend and invest either the same or more money on NPD and R&D in the coming year. Innovation will be a key part of their strategy for coming out of the pandemic and boosting growth in their business.

This new dynamic poses a real challenge for companies looking to launch new products or promote existing ranges. In the case of private label NPD, once the product and the price are good enough, people should buy it. But branded NPD is a different scenario. Innovation is the lifeblood of brands but this innovation needs engagement to hook the shopper’s attention and communicate the added values that justify its price proposition. Creating that connection with the customer is very challenging in a pandemic shopping environment.

Standing Out from the Crowd

So, the challenge for brands then is, how to make products stand out once they’re on the shelf? And how do you engage shoppers when you can’t do in-store sampling and you need your marketing collateral to cut through all the noise of COVID messages? A good place to start is by optimising the seven P’s.

Positioning

If you’re launching NPD, it has to be unique and it has to address a real consumer need. What this means is that you have to try to tick as many of the boxes around the big consumer trends at the moment:

- Does it deliver health for the consumer?

- Does it taste really interesting?

- Does it have a great provenance story?

- Is it convenient?

- Is it sustainable?

If you are ticking all of those boxes and meeting a real need, then your NPD has a vastly improved chance from the start.

Product

There are two basic things that brands should focus on. The availability and quality of the product.

Availability: Brand managers often ask themselves, “Why are my sales underperforming?” and the answer is poor on-shelf availability. Supply chain issues can lead to off-sales and if the product is not on the shelf, then it definitely will not sell. One of the best ways to ensure success is to focus really closely on availability.

Quality: Once upon a time, brand managers used to talk about consumers ‘trading down’ to the private label option. But private label brand managers have made significant headway in convincing shoppers that the quality of PL is the same as the brands, but with a significant price advantage. Now the table has turned, and the challenge for brand owners is demonstrate a reason for shoppers to ‘trade up’ to the brand. The key differentiator is the product quality and successful brands know that they must maintain a quality advantage over the PL option. Thankfully for brands, PL buyers turn over at a much higher rate and are driven by constant demands for lower cost prices. This can lead to some short-term decisions around tweaking quality or ‘value engineering’. And if successive PL buyers gradually remove quality over time, then they create a gap to the brands, especially if the brands are actively improving their quality.

Price & Promotion

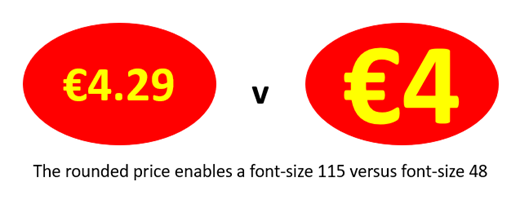

When you launch a product, you have to make choices regarding the retail price. Will a high-low strategy benefit long-term sales development, especially when the ‘high’ is many multiples of the PL equivalent? Is a mid-low strategy more credible? And should discounts be activated in a more targeted fashion through the loyalty card system? Perhaps an EDLP approach will deliver your objectives. And don’t forget that rounded price points will always speak value more than non-rounded. For example, a product flashed with €4 on the pack will always be more visually impactful than €4.29. You will always sell much higher volumes, and make much better profits with a flashed, rounded price point than trying to squeeze the extra profit out of the slightly higher non-rounded option.

Packaging

You’ve got to be really clear when you’re launching that you’ve got the right pack size, format and specification. This can be tested through home user trials and focus groups but really just requires the brand managers to truly put themselves in the shoes of the end-user, and not to compromise for the sake of production efficiency or margin on paper.

There is zero value in selecting a pack size which is too big, simply to achieve a lower price per kilo, especially if the excess product becomes in-home waste. Equally, the packaging has to function as intended. For example, there is no point highlighting that the pack is ‘resealable’ if the film gauge is too low and tears when opened. Finally, pay close attention to sustainability considerations i.e. reduce packaging without compromising the quality of the product. Create reusable packaging, use recyclable, renewable and recycled materials too.

Place

Getting your product into a feature space is still a good thing to do to support your brand or your new launch. Customers may be very deliberate in how they shop these days, and they may work from a list, but they do still look at the featured spaces like ends, coffin fridges, free-standing display units and the various other hotspots that different retailers have. Make sure that accessing these spaces is factored into your commercial proposition.

Of rapidly growing importance is the online ‘place’. How your brand is treated in the online store is hugely important. There is significant potential for retailers to enrich the online shopping experience. And even if the experience is not transactional, retailers like Lidl are showing how good social media can integrate with their Lidl Plus Rewards App to highlight new products and promotions.

POS

Using basic point of sale at the shelf is also a good idea. Brands that are very cost-conscious at the moment are reducing their in-store activations. They’re not even trying to compete with all of the noise that’s been created by the COVID-19 messaging. This could be a great opportunity for a brand to cut through right now because so many brands have decided to de-invest in their in-store activations. And as retailers start to pull back on the COVID messaging, smart brands will be front and centre with their POS activations.

The Future of New Product Launches

Retailers and brand owners must identify their target markets and communicate with them as effectively as possible. In the current environment, this will mean more digital communication and there are some excellent examples of companies using new tech solutions to create that essential shopper engagement.

Location based marketing uses Wi-Fi to connect with the mobile phones of customers when they approach a particular category in store. If the customer has previously interacted digitally with the store, and their data fits a certain profile, then they’ll get a very personalised message through their mobile phone, which will drive impulse purchases. Limitless Insight (https://www.limitlessinsight.com/) are a company offering location intelligence solutions.

Robotic interactive displays are another option for brands who want to really stand out. Tokinomo (https://www.tokinomo.com/) uses variations of light, sound and motion to interrupt and interact with customers and reportedly drives 4x sales uplifts from aisle shelves.

LED screens are an effective way to catch the consumer’s eye and rise above the drab and depressing COVID messaging. Tesco Ireland have recently implemented screens in their off-licence area to highlight offers on standard products and zero alcohol ranges. Screens can also be created to bring the shelf edge to life.

Near Field Communications (NFC) is a wireless technology that uses tiny radio transponders that can be attached to product packaging or point of sale material. When the NFC tag is detected by a reader, most likely a smart phone, this connection can be used to share personalised promotions that are time and location relevant. The tag detection is not dependent online of sight so the same tag can enable a checkout free exit from the store. NFC also allows two-way communication between the tag and the reader and enables the smartphone to become a contactless smart card. Companies like Ahead of The Curve Group (https://aheadofthecurvegroup.com/tapscan/) are using NFC and QR code technologies to enhance the shopper experience.

Immersive media experiences are emerging as a new way to grab the attention of tech savvy shoppers in a fast-emerging virtual world. Treasury Wine Estates ‘19 Crimes’ wine brand was launched using augmented reality videos, creating a ‘living wine label experience’ to tell the stories behind the products. Taking it a step further, Orb Media are the premium innovators of using interactive 360 photo and video content to help brands tell their stories with maximum, measurable consumer engagement. 360 content keeps consumer’s attention for 40% longer than regular content and creates an opportunity for premium, immersive consumer/brand engagements. (https://orbmedia.ie/what-we-do/)

Product sampling in-store was previously one of the most effective ways to promote trial of new products with a clear call to action delivering immediate sales results and some consumer feedback. In-store sampling is off the menu for now but ‘at-home’ sampling could be the next best thing. Companies like Whistl in the UK (https://www.whistl.co.uk/advertising/product-sampling), FMI’s ‘Sample It’ (www.sampleit.ie) and Mixtape Marketing’s ‘Samplify’ (https://samplify.ie/) in Ireland are helping brands drive sales by combining intelligent targeting and effective door drop logistics to get products right into their target consumer’s homes.

Conclusion

There is no doubt that grocery shopping has changed. The pandemic has prompted, in the short term, a less engaging in-store experience and has accelerated the move to online shopping. But the brick and mortar stores are still by far the largest channel in the grocery business. And with all of the additional costs of doing business in a pandemic, retailers will be keen to carefully manage their margins. That means balancing the mix of brands and private labels, commodities and innovation. Both retailers and brands will have no choice but to re-connect with shoppers. So, it will be as important to rediscover and double down on the good old basics of retailing like price points, quality and availability. But there are also opportunities to harness these new technologies, blurring the boundaries between the online and instore experience and creating a truly omnichannel proposition. Any other course will lead to declining market share and declining profits.

Malachy O’Connor

Retail Industry Consultant & Director at Food First Consulting www.foodfirstconsulting.ie

Partner at International Private Label Consult www.iplc-europe.com

Partner at Uspire Ltd. www.uspire.co.uk