Introduction

Christmas 2020 was all about protecting vulnerable relatives, avoiding big family gatherings and as a result we saw an increased number of smaller get-togethers which had a knock-on impact on demand for smaller portion sizes. New Year 2021 brought hope of normality through the vaccine roll-out and most people had planned for a relatively normal Christmas 2021. Then the omicron variant kicked in and a huge number of individual family members were required to isolate during Christmas. Planned family gatherings were cancelled, and again, many were unable to travel home from places like the UK.

Trajectory

Grocery retail sales had established somewhat of a pattern in the second half of 2021. Sales were tracking approximately -5% down versus 2020 as we were overlapping more restrictive lockdowns that drove consumption away from the hospitality industry and into grocery retailers. But sales were running +9% versus 2019 as cafés, restaurants and hotels still struggled to deal with lower demand, especially in the cities, and lower capacity due to staff shortages. Again, throw in the omicron wave and Christmas 2021 was expected to be another buoyant season for grocery retailers as many people avoided hospitality environments leading into Christmas. But there were other challenges with avian flu outbreaks, cost inflation pressure coming through from suppliers, supply chain disruption impacting availability and some nervous shoppers who were stocking up as early as September and October.

Pre-Christmas Survey

In December 2021 we carried out a limited survey of shoppers shared via LinkedIn, Facebook and direct mails (132 ROI Respondents). Many of the questions were repeated from the 2020 survey and were also replicated in a UK shopper survey (67 Respondents) so despite the small sample size some interesting comparisons can be made. Average household size was 3.8 people and average total household income was €102k per year.

Christmas 2021 Shopping Intentions & Market Share

As per last year, our survey demonstrated that many shoppers who were happy to give their weekly trolley to a discounter intended to do the big Christmas grocery shop in a multiple. In terms of the key beneficiary, the data suggested minimal benefit to SuperValu, moderate to Tesco but a significant uplift to Dunnes.

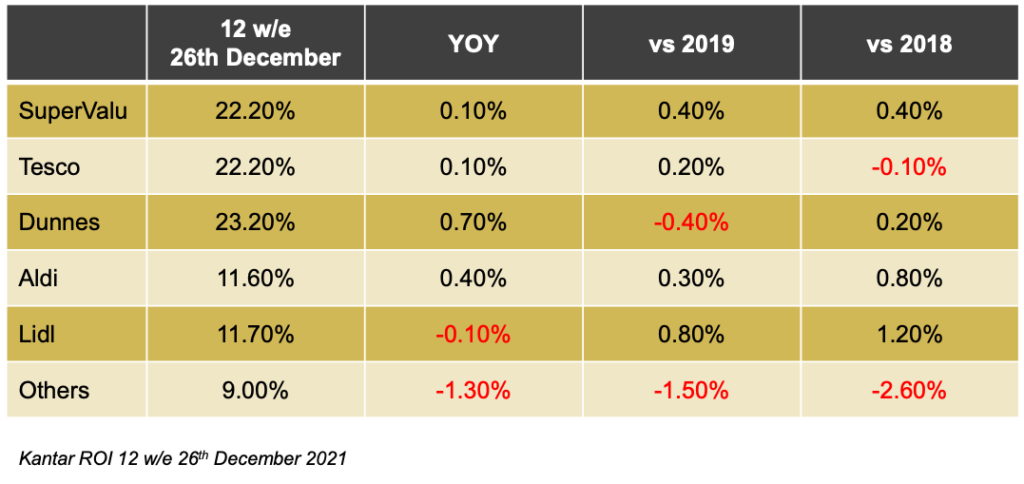

These intentions were borne out in the Kantar Data where Dunnes grew share to 23.2% for the 12w/e 26th December. This was up +0.70% versus 2020 which is not bad for a retailer that has yet to roll-out a full online solution.

Tesco were joint second with SuperValu at 22.2% with both retailers gaining 0.10% on 2020. As usual the discounters lost share in Christmas trading, declining a full 2.3% from their combined peak of 25.6% share for 12w/e 08-August. Whereas the multiples gained 2.8% during the same period. This was thanks to larger stores, bigger ranges, more options to trade up, longer opening hours and vouchers.

Other Survey Learnings

Availability

24% of respondents had done some early Christmas shopping due to concerns around pandemic disruption of supply chains. This compared to 34% in UK where there were additional Brexit related concerns. Interestingly, all retailers actually had significantly better availability of the whole range right up to Christmas. It’s not clear of this was due to unintentional over-ordering or a strategic decision to maximise market share through availability. The upshot is that most retailers had a reasonable over-hang of seasonal stock as they entered 2022 but this may have been an accidental blessing since post-Christmas staff absenteeism has created significant range gaps around the stores in January. The only exception on availability was on fresh turkey where retailers were 100% sold out by early afternoon on Christmas Eve.

Cross-Border

For the second year, the pandemic has halted the rush of ROI shoppers doing a trip to NI. This will come back on the radar in 2022 thanks to the new minimum unit pricing rules on alcohol. This will definitely have an impact on ROI grocery sales since some of the shoppers on a ‘booze cruise’ will pick up grocery items too.

The Big Trolley

Again, approximately 85% of shoppers continue to shop in their regular store of choice at Christmas. The 15% ‘swing’ shoppers are generally discount shoppers who are more price sensitive and can be attracted by Dunnes’ voucher strategies. The reality is that most shoppers have a preferred discounter and a preferred multiple so many of the switching ‘discount’ shoppers are actually also Dunnes shoppers and will have received their Dunnes Value Club vouchers by early December, allowing them to create additional momentum through the €10 off €50 Shop & Save vouchers.

Online

10% of ROI respondents intended to do their main Christmas trolley online in 2021, in line with 2020. Kantar data shows that 17% of shoppers did some online shopping in the 12 weeks to Dec-26th. This number was 32% for UK respondents which reflects the challenge of managing delivery costs in Ireland given the lower population density.

Local

Only 5.4% stated an intention to shop in small local high street food stores. This is down significantly from 14.5% in 2020 when there was a wave of support for local businesses. This is reflected in the Kantar data where ‘Others’ account for 9.1% share, down -1.3 share points versus 2020 and -2.6ppts since 2018.

Advertising

For the second year, SuperValu had the most liked supermarket TV ad with 67% of respondents flagging it as their favourite despite SuperValu being the multiple least likely to pick up a switching discount shopper. There is an old saying in the marketing world “I know half of my marketing spend is working, I just don’t know which half”. I think its relevant in this case, but I am becoming more and more certain that the big Christmas Ad is a vanity exercise for retailers. Tesco do a fairly simple, low-cost ad, Dunnes have been using the same ad for 5 years and both of them pick up more of the floating shoppers. When asked about the different forms of advertising that might influence where they shop, respondents gave the following indications:

- 7.6% could be swayed by the big Christmas TV ad that pulls the heart strings

- 24.8% could be swayed by newspaper ads

- 28.8% felt they could be influenced by a nice glossy Christmas food brochure

- 59.5% felt that voucher-based activity would help them decide where to do the Christmas shop

These numbers demonstrate just how smart the Dunnes approach is. Saving money on the annual big TV ad and directing spend into their Value Club mail-out, Shop & Save Vouchers and their Christmas Millionaire Raffle where winners could get one million value club points.

Product Preferences

With regard to product choices, 23% said that they intended to buy more premium private label products for Christmas ’21 compared to 15% who would buy more brands and 11% who were planning to buy more ‘Value’ PL. This tallies with the Kantar data which showed that Premium PL ranges grew ahead of the market.

- 12.9% were planning to buy more vegan/vegetarian products at Christmas ’21

- 41% were planning to make more eco-friendly product choices

- 63.6% were planning to buy more local products, just not in local stores, which shows that the supermarket’s provenance messaging is cutting through

- 40.5% were planning to buy more ethically sourced products for Christmas ‘21

With regard to the Christmas dinner, 92% were planning Turkey with 76% planning Ham. The other options like beef, duck or goose pale into insignificance compared to Turkey and Ham but vegan/vegetarian continues to break through with 7% of respondents stating that they would serve plant-based options for the Christmas lunch.

Pandemic Anxiety

On the pandemic, 33% of respondents were still nervous about shopping in a supermarket and 55% reckoned that the omicron variant was making them nervous about eating and drinking in pubs and restaurants. This is reflected in Kantar data when we see that the 4 w/e 26-Dec sales were only -0.6% versus 2020, when the preceding five 12wk periods were showing a run-rate of approximately -5%. This was a buoyant season for grocery retailers and shoppers were still carrying some anxieties despite vaccines and boosters etc. 36% of ROI respondents expect another full lockdown in 2022, rising to 45% for UK respondents. 85% of ROI and UK respondents are anticipating some continued covid related disruption in the coming years,

Spending Power

38% of ROI respondents expect an economic recession in 2022 and 83% expect to pay more for their groceries. 16% of respondents had already experienced a decrease in their household spending power in 2021. The average weekly spend on groceries was estimated at €162.42, with another €54.57 spent outside the home.

When asked what they would do if grocery prices rose by 10% respondents gave the following answers. In summary, whilst cost inflation would put some households under pressure, many of their mitigation strategies do not require them to switch stores. Rather, depending on how retailers manage their mix of price tiers, shoppers can often stick with their current store and the retailers might not see significant impact on market share performance:

- 31% said they would switch from shopping in a big supermarket to a discounter. Discounter penetration is already high so we shouldn’t expect a mass exodus from the Big 3,

- 46.6% would simply absorb the cost increases and make no changes,

- 47.7% said they would switch into ‘value’ PL products and all retailers have a range of ‘basics’ in value packaging so this may not prompt switching,

- 54.5% said they would switch out of brands into mid-tier PL products. This can be done within a multiple environment and doesn’t necessitate switching to a discounter as long as the supermarkets are loud and proud of their PL ranges,

- 59.1% said they would cut back on spending in cafés and restaurants which keeps spend in the supermarkets,

- 62.6% would shop around the supermarkets to seek the best promotional offers. This could cause some turbulence with supermarkets competing to shout out their headline offers,

- 69.5% said they would switch to cooking more meals from scratch but again, all of the retailers have a robust range of commodity products that are price-matched in the market so this will not necessarily prompt switching.

When probed on what factors might make shoppers happy to pay more for groceries, respondents said they would pay more for certain features:

- +5.2% more to ensure that retailers could pay a fair price to their suppliers

- +5.2% more for eco-friendly products

- +5.4% more for ethically sourced products

- +6.6% more for higher quality products

- +7.1% more for locally sourced products

Price Survey

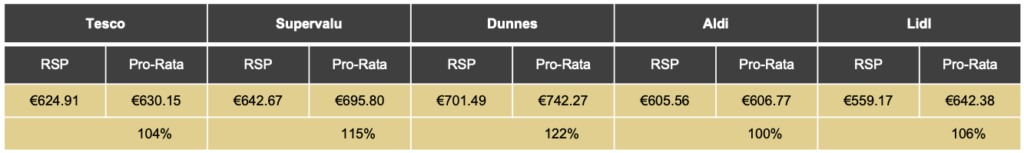

We surveyed over 100 SKUs across all key categories in Tesco, SuperValu, Dunnes, Aldi, Lidl and M&S finding 88 common items in the Big-5 stores. Prices were then pro-rated to an industry standard pack size and totalled as follows. Aldi was cheapest pro-rata so we used this as the baseline and indexed the others versus Aldi.

Reviewing the detail, it becomes clear that the price proposition of a retailer can be heavily influenced by one or two headline deals or low volume loss-leaders. For example, in Lidl I couldn’t find any Guinness 24 can slabs and their €19.00 twelve-pack deal left them at a distinct disadvantage versus the market. Again in Lidl, their €15/70cl Jameson deal gives them an advantage on paper but I couldn’t find much stock.

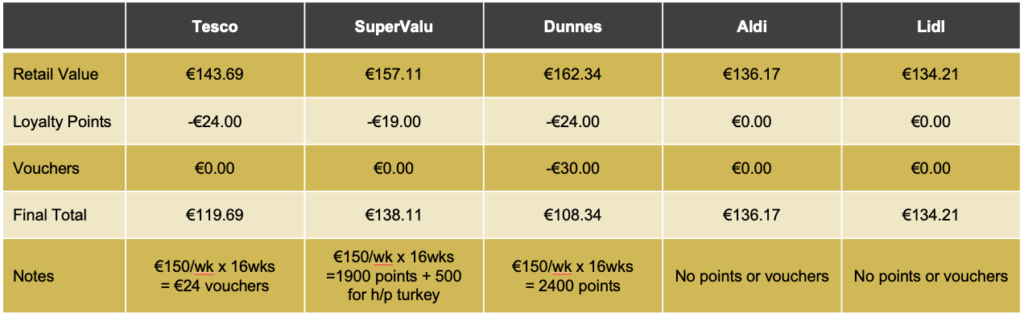

From a customer point of view, its more useful to look at a more restricted selection of thirty must-have seasonal products. This is a much more realistic ‘big trolley’ and gives us the opportunity to replicate the customer experience by adding the impact of vouchers to the actual pack prices.

This exercise brings the value of vouchers and loyalty card points into focus since Dunnes can start with the highest top line prices but still be the best value after the loyalty points and Shop & Save vouchers are included. This helps explain why the discounters lose so much market share at Christmas and why Dunnes make the greatest switching gains. Aldi and Lidl’s combined share fell from 25.4% for 12w/e 31-Oct to 23.3% for 12w/e 26-Dec. Their combined share fell to around 21% for the 4w/e 26-Dec and possibly as low as 18% in the final week to Christmas Eve.

Innovation & Product Differentiation

Earlier in the year there was some speculation that ranges would be simplified for Christmas 2021 thanks to two challenges:

- Supply chain disruption would impact planned availability

- Labour challenges and rising costs would lead to decisions to simplify operations

As it turned out, the 2021 seasonal range was the best that I have ever seen in the Irish market for a number of reasons:

Availability

All of the main five stores managed availability from an early pre-Halloween start right up to Christmas eve. In previous years I have sought to do a seasonal price comparison across all five retailers but have struggled to find more than 40 common products in the last 10 days before Christmas. This year we were able to find 88 common items and there was an over-hang of availability into January ’22.

Range Gaps

All five retailers have effectively done their analysis and have filled the obvious range gaps. For example, Tesco launched private label chocolate reindeers and stollen products. These were previously only ever stocked by the German discounters. SuperValu especially have reduced their dependence on branded products and have ramped up their seasonal PL ranges.

New Product Development

There was some really interesting and ambitious new product development:

- Dunnes’ Simply Better range was excellent, but so was their mid-tier PL range across all categories. Their premium cheese boards and gift boxes really stood out and they even had a vegan cheese selection.

- Lidl’s fresh premium seafood range was excellent and included fresh scallops, oysters and even fresh carp for Eastern European shoppers.

- Tesco’s finest breakfast pack stood out in the market. They had the best quality and range in fresh cut flowers and their vegan and plant-based ranges were very visible especially in traditional Christmas fare like mince pies and puddings.

- M&S Lobster en Croute and their famous Sparkling Gin were real showstoppers and their ‘Sprout Trees’ gave a farmers market feel.

- SuperValu Lucan’s cheese counter stands out among its peers and their in-store butchers still offer de-boning to customers buying whole hams. It’s a dying market but a nice touch still. The Signature Tastes Christmas puddings, chilled party food and antipasti ranges were excellent.

- Aldi had a stunning Specially Selected range. There really isn’t any food and drink product that could be considered beyond their brand reach. They will have a crack at anything. Their party food and boxed Irish Rib Roasts were stunning and their Zero Alcohol Prosecco was flying off the shelves.

Learnings for Suppliers & Retailers

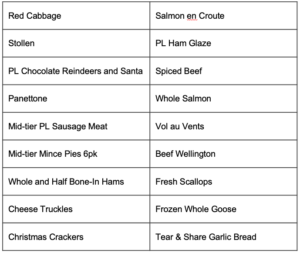

Range Gaps

There are still significant range gaps to fill for Christmas 2022. Here is a list of key seasonal SKUs carried by some, but not all, retailers:

New Product Development

Suppliers need to be proposing NPD and new concepts in Jan/Feb 2022 to secure business for Christmas 2022. It might seem a long way off but the big decisions are being taken right now. The survey suggested shopper appetite for the following NPD categories:

- Eco-friendly

- Local/Irish (are all the import substitution opportunities now done?)

- Ethically sourced / Socially conscious

- Premium PL

- Value PL

Shoppers are willing to pay more for these products which may help both suppliers and retailers pass on some inflation by increasing average selling prices.

Food Waste

There is a significant opportunity to reduce food waste for Christmas ’22. I saw too many examples of fresh product that had a use by date but could carry a best before or no date. Similarly, too many examples of Christmas day products dated pre-25th December. Extended frozen ranges could be part of the solution. However, the industry needs to do more PR around quality perceptions in the frozen category.

Ethical Products

40% of survey respondents said they intended to buy more ethical products. There is an opportunity to expand the range of ‘charity’ products where a portion of the retail value goes to a cause e.g. Tesco’s ‘Temple Street’ flower bouquet. Retailers could reallocate TV ad spend to support this.

Minimum Unit Pricing

The introduction of minimum unit pricing on alcohol will create two challenges in the market for Christmas ’22.

- Firstly, there will be significant cross-border shopping to access deals which will impact all ROI retailers.

- Secondly, due to their limited store size, the discounters were never truly able to trade the big beer slab deals at Christmas. This handed an advantage to Tesco, Dunnes and SuperValu. The Big 3 will need to find new options for big ticket headline deals during Christmas ’22 and given Dunnes’ success with money off vouchers, we might see a return to this tactic across the market.

Wrap Up

2022 will see yet more turbulence and as always this will bring opportunities. Here are some possibilities to consider:

At Home

- Discounters will open 5-6 new stores each and combined value share will hit 26%

- Dunnes will be looking to go online nationwide

- M&S Ireland will get on top of its supply chain challenges and start opening stores

- Tesco will grow thanks to Joyce’s acquisition and further c-store openings

- Minimum Unit Pricing will reignite cross-border shopping

Internationally

Food inflation will continue through 2022. Suppliers will need to seek a second or third cost increase and retailers will need to start passing the inflation through to shoppers.

New covid variants will continue as the developed world continues to stall on helping developing nations’ vaccine programs.

Geo-politics will continue to hit food costs with Russia/Ukraine conflict and sanctions driving up Russian wheat duties and then global prices.

Consumer spending power will take a hit from inflation, rising interest rates and increased unemployment

Retailers and suppliers that consider these disruptive forces will be more prepared and agile for what will be yet another unpredictable Christmas in 2022!

Malachy O’Connor

Retail Industry Consultant & Director at Food First Consulting www.foodfirstconsulting.ie

Partner at International Private Label Consult www.iplc-europe.com

Partner at Uspire Ltd. www.uspire.co.uk