Headlines

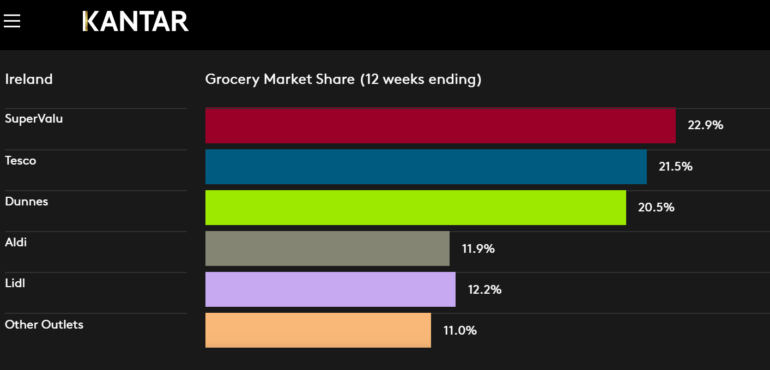

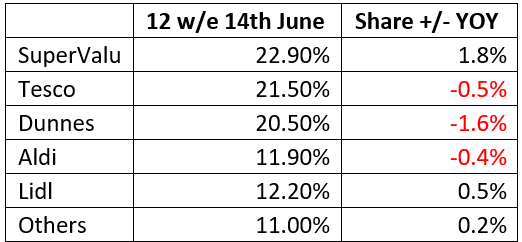

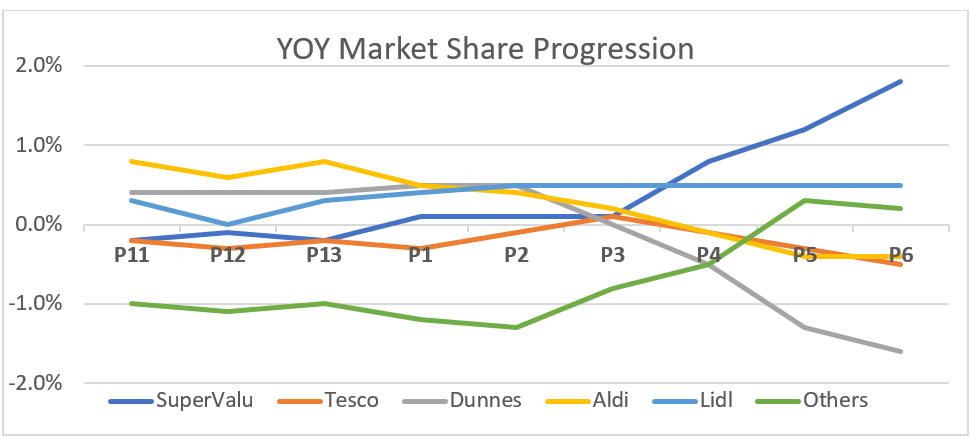

The Kantar Worldpanel data for the 12 weeks to June 14th places Supervalu in 1st place with 22.9% market share of the take-home grocery market. Tesco have solidified second place with 21.5% and Dunnes stay third, having slipped further to 20.5% market share. Lidl are fourth with 12.2% and Aldi are fifth with 11.9%.

Out of Home shifts to In-Home

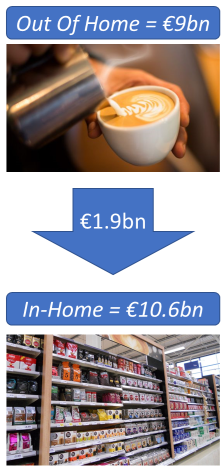

Every retailer has seen significant sales growth in the last 12 weeks of Covid-19 lockdown. The take-home groceries market grew by +24.7% and it wasn’t due to panic buying or sales of hand sanitiser and hair colouring. Rather, the primary reason for this unprecedented uplift was the almost total closure of the ‘out of home’ sector. I don’t think any of us fully realised just how much we were spending on coffees, lunches, restaurant meals, take away food and the few sociable pints in our local. But in lockdown, these options were removed and all of our consumption switched to in-home i.e. purchased in a supermarket.

These numbers are all estimates, but the out of home sector (food, drink and alcohol) is thought to be worth over €9bn in sales per year. But, eating and drinking out of home is 4-5 times more expensive so maybe 20-25% of the €9bn transferred, creating growth of between 16% and 20%.

Other Factors

So, why is the Irish market growing at almost 25% when the UK grew at +13.7%?

- Depending on factors like exchange rate and the price of diesel, cross border shopping has historically represented between 0.5% and 1.5% of the ROI market. Lockdown restrictions would have retained most of this spending within the ROI located stores.

- The average selling price has increased as shoppers are switching to brands, and brands cost more than private labels. During the ‘peak fear’ period in mid-April, shoppers were looking for the reassurance of trusted brands. But as time has progressed, the switch to brands can be better explained by two factors.

- SuperValu and Centra are the biggest beneficiaries of store level switching and both of these are more branded houses, especially relative to the discounters.

- Some retailers have prioritised the availability of brands over private label due to the positive impact on margin mix.

- Shoppers have been staying ultra-local. For many, this means shopping in a convenience store and there is always a premium for this.

- Supermarkets have taken the gas off some promotional activity. Initially this was to deter bulk buying but other factors came into play as the lockdown progressed, and we can see this clearly in the alcohol and produce categories. For instance, with families locked down and going stir-crazy, it would have been morally questionable to promote 24 cans for €20 this Easter. Furthermore, the supermarkets have taken a huge hit in their operating costs. All of the extra staff, frontline bonuses, sanitation protocols, POS, etc. come at a cost. So, rather than putting up prices, they can play around with the weight and penetration of promotions. We can see this in the various Super-5’s, Super-6’s and Super-7’s as there have been a lot more low-volume products, and not necessarily at the traditional 49c price-point either.

- Whilst many people have taken an income hit, many others continued to work from home but with only a tiny fraction of the costs they would usually have. The central bank has reported a record increase in household savings. And some shoppers are actively looking to trade up and spend more as a treat to help them get through this difficult time.

So, what does the future look like?

1. Turbulence For Retailers

Firstly, in the short-term, it’s going to be a period of continued turbulence for grocery retailers. As the restaurants and pubs start to re-open, some of that spending shift will drift back to the out of home sector. But, on the other hand, there won’t be any ‘summer dip’. The hundreds of thousands of Irish families that normally travel overseas will have to make do with a staycation this year. It will be a challenge to forecast the volumes so extra communication is advisable.

2. Online

Secondly, it will be fascinating to see how the online channel evolves. Kantar reckon that the channel has grown by 114% year on year in the last 12 weeks. Tesco are investing in increased capacity, SuperValu have picked up lots of new customers. Centra did an excellent job of launching their online service so quickly. Lidl continue to partner with Buymie.ie and both Aldi and Dunnes have commence trials partnering with Deliveroo and Flipdish respectively. But the bottom line is that it’s almost impossible to make money in online groceries. So supermarket businesses, that pride themselves on paying market leading rates for their own staff will likely tread with caution. It’s one thing if the partnership is based on speed of entry in a complex channel. But it’s an entirely different proposition if the only way to make commercial sense of online groceries, is by engaging the gig economy.

3. Storms Brewing

I think we’re all agreed that the long-term economic outlook isn’t good. But the majority of consumers have not yet seen a major reduction in their spending power. We’ll get a truer picture by the end of the year, and it might be quite bleak for consumers. The last recession led to a significant golden period for the discounters as shoppers swapped and saved. But the terrain is different now. The discounters do not have the same price advantage, in Ireland at least. Tesco, Dunnes and SuperValu have all invested in vastly expanded private label ranges, some form of EDLP and price-matching activity supported by a price index that is measured frequently to spot any movements in the market. This has led to significant deflation, since 2014 especially, when Tesco commenced their re-set and turn-around plan. And the discounters have themselves evolved in both sophistication and complexity, with massively expanded ranges of short-life, fresh and premium products introducing factors like food waste, which would previously have been a non-issue.

The future is likely to be just as challenging for suppliers. After a period of close collaboration between retailers and suppliers, keeping the supply chain full and shelves stocked, it looks like there’s considerable pressure building. The retailer’s margin mix has been skewed heavily, their costs have gone up, there’s a recession coming down the tracks and the discounters are still expanding their store estate. The UK Grocer magazine has reported that Tesco UK have kicked off a new strategy just this week, giving suppliers until 10th July to agree to cost price reductions and a switch to EDLP and Clubcard loyalty promotions to support a price war with Aldi. Smart suppliers will be investing in efficiency, commercial strategy and cost-killing projects so that they can better brace themselves for the storm that’s brewing.

Malachy O’Connor

Retail Industry Consultant & Director at Food First Consulting www.foodfirstconsulting.ie

Partner at International Private Label Consult www.iplc-europe.com