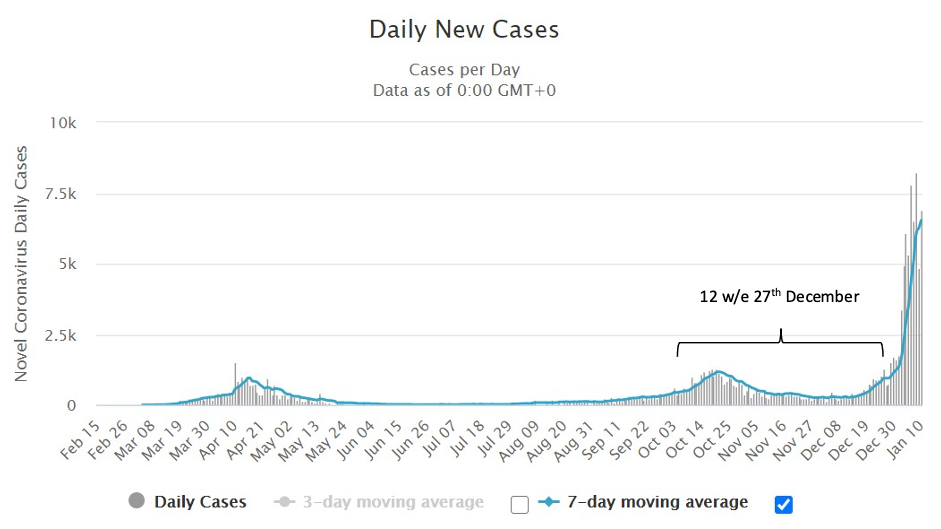

2020 was unique to say the least and Christmas past was just as odd. The latest Kantar data covers the period from 5th October to 27th December which effectively corresponds with the second wave of the Covid-19 pandemic. As such, the period is characterised by the October lockdowns, the Christmas re-opening and the now familiar ebb and flow of food and drink purchases between grocery stores and food service outlets. The market grew by 17.0% in this 12-week period which represents over €450m extra spent on take-home groceries in the last three months of the year.

Christmas Survey

Knowing that the pandemic would have a major influence on Christmas grocery shopping, I launched an online consumer survey in early December, looking to gauge consumer sentiment on various points of interest. I asked consumers about their intentions regarding the big Christmas trolley shop, which supermarkets they intended to shop in, how they intended to shop, when they would do their big Christmas shop and the kinds of products they were looking for. Some of the insights are borne out clearly in the latest Kantar data.

Top-Level Kantar Data

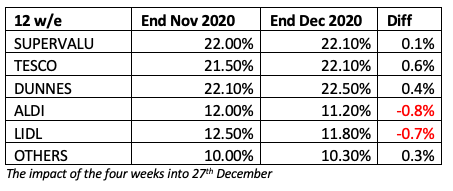

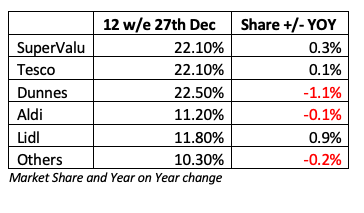

The Kantar Worldpanel data for the 12 weeks to December 27th sees Dunnes stay in first place on 22.5%. SuperValu and Tesco are joint second on 22.1%. Lidl are fourth with 11.8% and Aldi are fifth with 11.2%.

Tesco & Dunnes

There are no major surprises in this data. My survey indicated that 80% of shoppers intended to do their big Christmas trolley shop in their regular store of choice. This means that 1 in 5 shoppers were open to switching. The survey suggested the discounters would lose share in the last four weeks of the period, with Tesco and Dunnes being the key beneficiaries. This is pretty much exactly how it played out, with discounters losing share versus the previous period as some shoppers switched to Dunnes and Tesco with their larger stores and more options to trade up and treat for Christmas. These larger stores are better able to stock, display and sell the vast quantities of goods that are required to win market share. They also issue loyalty card vouchers in advance of Christmas, narrowing the value gap to discounters. Shoppers are under time pressure in the week before Christmas so they want a one stop shop. In short, shoppers who want to spend less money 51 weeks of the year, splitting their shopping between a discounter and a bigger multiple supermarket, actually look for ways to spend more money and do it in a single location in the week before Christmas.

Why don’t SuperValu pick up as much as Dunnes and Tesco?

If 80% of all shoppers were intending to stick with their regular store for the Christmas shop, this number is 94% for SuperValu. Christmas shoppers that are open to switching tend to be tempted by the bigger ranges but are also looking for brands, big ticket promotional offers and money-off vouchers etc. SuperValu perhaps seal their Christmas fate by linking their half-price turkey offer to shopper loyalty in the previous 6 weeks, requiring customers to collect 500 loyalty card ‘points’ in the 6 weeks to mid-December to access a turkey at €2.99/kg. So, what they have at the end of November, they tend to hold for Christmas. The problem is that the Turkey mechanic isn’t enough to attract the shoppers that are switching just for one week, and operators like Tesco or Dunnes do a better job of grabbing the switchers by deploying more robust promotions on items like beer slabs and by offering money off vouchers.

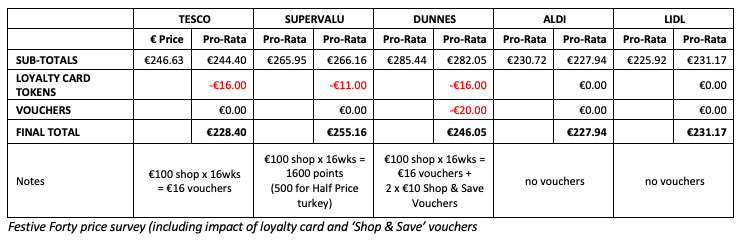

The ‘Festive Forty’ best value Christmas Shop

I did my annual Christmas price survey using the leaflets, press ads and in-store checks on 20th and 21st December. I surveyed a selection of Christmas essentials across, bakery, fresh produce, dairy, chilled foods, meat, fish, poultry, ambient grocery and off-licence. I targeted a ‘festive fifty’ but found that even core items were not stocked or available in all of the big five retailers. Thus, my list doesn’t include items like poinsettia, salmon en croute or cheese boards and was scaled back to a ‘Festive Forty’. Prices were collected based on the advertising and shelf edge labels and I tried as far as possible to find comparable items. The actual price was then pro-rata’d to an industry standard weight to correct for minor pack size differences. The potential impact of loyalty card vouchers and Shop & Save vouchers was then subtracted to give a final total.

In summary, Aldi was cheapest, but there was very little difference between Aldi, Lidl and Tesco because they monitor and anticipate each other’s competitive position, especially on the most popular lines. Tesco’s club card voucher mail-out puts them in the mix with the two discounters. The other observation is that Dunnes is the most expensive by far until their strong voucher strategy kicks in. SuperValu are just that little bit more expensive, another reason why shoppers switching out of Aldi and Lidl are not choosing them.

Year on Year Performance

The biggest winner year on year is Lidl. It is true that their market share did decline in the four weeks into Christmas, but this trend can be seen every year. They will be really happy to have gained almost one full percentage point year on year, in a market that was 17% bigger than last year. We’ve covered it in previous articles, but the core of this performance is that they have the second widest chain of stores with more locations than Tesco, Aldi and Dunnes. This gives them a proximity advantage when shoppers are tending to stay local. They also have larger stores on average than Aldi, and these stores tended to have lower footfall pre-pandemic. This gave them a stronger starting point for a crisis that saw huge sales uplifts in take-home groceries and required more space to ensure social distancing. Add to this that they really haven’t put a foot wrong in any of the other competitive territories such as hygiene, traffic management, value and product range.

Managing Footfall

So, at Christmas, as per the peak grocery sales periods, the retailers’ performances were somewhat tied to how they could manage the extra volume of products and people. Most stores extended their Christmas opening hours to allow for social distancing and reduce the chance of lengthy queues. I think Lidl and Tesco communicated most effectively on this, requesting shoppers to use the quiet hours and maintain the one person per trolley rule. I also noted that Tesco and Lidl had installed covered queuing areas in some locations to protect their shopper from the elements.

Dunnes did introduce a slot booking app but it wasn’t enough to avoid some queues, especially on 23rd December. This may have contributed to their challenge, losing -1.1% market share year on year. The 23rd December peak day was easily predictable and may well have been a bigger problem for queues had shoppers not taken matters into their own hands. 15% of my survey respondents said were doing their Christmas grocery shopping in small local stores rather than big chains and 10% said they intended to order online for either delivery or collection. 35% of respondents also indicated that they were spreading out their Christmas shopping through December to avoid queues on the busy days. These three factors certainly helped the big chains to better manage their footfall challenges in this very unique Christmas trading period.

Northern Ireland

No Republic of Ireland respondents intended to do any of their Christmas shopping in Northern Ireland. This was a big change on previous years when up to 10% of respondents did a cross-border trip to buy mainly alcohol and non-food items. Diesel prices and exchange rates were irrelevant this year as ROI shoppers were spooked by the COVID-19 numbers in NI. This factor, and the almost complete absence of duty-free booze helped boost Republic of Ireland’s supermarket alcohol sales by +33% year on year during December.

Favourite Christmas Ad

SuperValu’s ad with the little boy and his grandad was the most liked by a long stretch. 65% of respondents said it was their favourite, where Aldi’s Kevin the Carrot and Dunnes’ Make Christmas Special ads were the most liked in previous years.

SuperValu definitely captured the moment but did it actually drive any new customers to their stores at Christmas? My research would suggest not many. In normal circumstances, to win big, supermarkets need to be doing something disruptively positive to pull new customers in, or their competitors need to be doing things that are really negative, pushing them away. My view is that these brand ads help show your loyal customers that they’ve made the right choice by sticking with you, it’s an investment in long-term loyalty.

Product Preferences

The survey asked shoppers what they were planning to buy more of this Christmas versus last year. There were two big take-outs.

- Different shoppers trade up and treat themselves in different ways. 14% said they planned to buy more brands this Christmas, where 28% said they planned to buy more premium private label. For most of 2020 brands have grown at a higher rate than private label. But remember, private labels are generally less expensive so they could be generating higher volume growth. The momentum is moving towards private label anyway, and in a sign that the economy has already tightened, 10% of respondents said they were planning to buy more ‘value tier’ private label during Christmas 2020. Kantar called out growth of +17.8% for premium private label products so expect this to continue into 2021.

- Before the pandemic there was Greta Thunberg and Blue Planet. In January 2020 I reported on how the vegan phenomenon had made its way into all areas of food retail and food service. We’ve been focused on COVID-19 since then but the momentum continues. 16% of respondents said they were planning to buy more vegan or vegetarian foods this Christmas and 10% were planning vegan/vegetarian options for Christmas lunch, up from 6% in 2019. Plant-based will continue to grow in 2021 as shoppers look to mind their health and the planet, regardless of whether the pandemic ends or not. 45% of respondents had said they intended to buy more eco-friendly products for Christmas 2020. And 73% had indicated they would buy more locally produced products. This was brilliant for the local economy and it supports the sustainability agenda by generating less food miles.

What was on the menu and who was at the table?

Christmas is all about traditions, and the pandemic made these traditions somehow more meaningful, more needed, during Christmas 2020 . It was no surprise then that 88% of survey respondents were planning to have turkey of some form for Christmas lunch. One key difference this time however was the restrictions around mixing household bubbles and protecting vulnerable family members. This had a noticeable impact with 35% of respondents expecting less people around the Christmas dinner table, a number that may have turned out to be higher thanks to the late introduction of travel restrictions from the UK. The effect was to create a higher number of smaller gatherings during Christmas 2020. Kantar’s data reflected this in the switch from whole turkeys into turkey joints and other smaller cuts. The retailers managed this dynamic quite well and I didn’t see any significant stock over-hangs, but that might also suggest localised shortages. But when it comes down to it, stressed shoppers will generally buy whatever is available. So, there might have been a lot of households who bought a way bigger turkey than they needed, or couldn’t get a Turkey and had to opt for something else.

Looking Forward to 2021

It’s worthwhile taking some time to understand how the pandemic has already impacted consumer behaviour around shopping and food preparation. Establishing this understanding can help when planning new product development and category strategy for the coming year. Here are the key take-outs:

- The food service sector and ‘out of home’ consumption had a horrid time in 2020 and H1 2021 looks like a continuation of this. Consequently, 76% of respondents are preparing a lot more food at home and 66% are buying more scratch ingredients for cooking at home. The problem is that the average shopper has a limited enough cooking repertoire and 58% reported that they were bored cooking the same meals every week! This is an opportunity for manufacturers and retailers in the coming year.

- Looking after our health has been very front of mind this past year especially. 56% of respondents said they were eating more healthy foods since the pandemic. 36% disagreed with this statement, though and a similar cohort of 28% reckoned they were drinking more alcohol since the pandemic. Clearly the pandemic, working from home, preparing food with minimal skills and the generally heightened anxiety has driven a section of society into unhealthier habits. But the data would suggest that a majority have been driven toward healthier ways and 2021 NPD should reflect this, not just for January.

- 28% of respondents were still worried about catching the coronavirus on a supermarket shopping trip. This comes despite the retailers introducing new sanitising procedures, social distancing, mandatory face masks and traffic control systems. This will continue to drive demand for online shopping and it has also highlighted a new competitive territory – ‘safest place to shop’.

It’s clear that the increased socialising in December has led to a third wave. Most survey respondents were fully expecting the current period of restrictions into early 2021. But what are the prospects of some normality later in the year? This depends largely on the effect of the vaccine program and the impact of the pandemic on the economy.

- 49% or respondents said they would get the Covid-19 vaccine as soon as it becomes available. 21% said they wouldn’t and 31% said they were unsure. Looking at it from the other direction, only 9% said they had no intention of getting the vaccine. Setting aside the early adopters and outright rejecters, it will be about people feeling sufficiently reassured. The ‘unsures’ will likely row in eventually, and with a phased roll-out they will get the chance to observe the process over an extended period whether they like it or not!

- 88% were expecting another lockdown in 2021 so the introduction of post-Christmas restrictions didn’t surprise most people. Again, we see that the people were well ahead of the politicians in their thinking. 73% expect to continue working from home at least some of the time in 2021.

- 37% were planning to go on a foreign holiday in 2021. Who knows when exactly this might happen, but it does signify an expectation that some normality might return, supported by a vaccine programme that’s expected to be delivered in the first half of 2021.

- 69% of respondents expect an economic recession in 2021.

Wrap Up

Taking all the learnings from 2020 and the insights from this research there are some key take-outs.

Lifestyle choices will drive the continued growth in healthy eating, online shopping, sustainability and new experiences. If your new product development tastes sensational, is good for your health, good for the planet, profitable for both retailers and producers, and easy to shop and prepare then it should be a winner.

Supermarket store choice will continue to be driven by habit. It’s only through true disruption that a supermarket can generate real, long-term switching and loyalty. So, in 2021 we can expect to see market share continue to be influenced by variations on travel restrictions and the rules around the food service sector. We can also expect to see ‘safest place to shop’ emerge as a key influencer. And if supermarkets prioritise the value that’s taken in the till over the volume that’s put in the trolley then they will be found out and shoppers will be pushed into the competition.

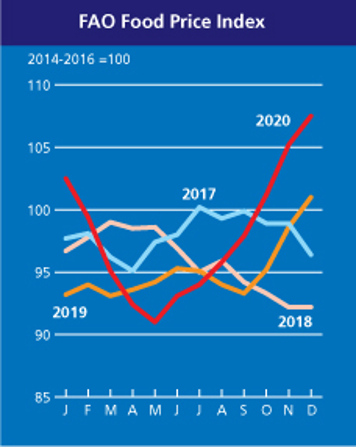

Product choices will be driven by a desire for quality and value for money, whilst supporting local businesses. Expect to see private label sales growing faster than brands, but also be aware that customers can spot when retailers are being disingenuous around value, product origin and their support for local producers. Retailers need to actually support producers, paying fair prices in these times of turbulence around product availability, rising commodities, new customs costs, disrupted supply chains and fluctuating exchange rates. Retailers cannot expect to take the benefits of provenance-based PR without accepting responsibility for their role in a supply chain that can afford all players a reasonable margin. Continuous retail price deflation is not an inevitability, since it reflects a retailer’s ambition for more market share more than responding to a consumer demand. Expect to see some inflation during 2021 and suppliers prioritising availability with retailers that play fairly.

Join me at 10:00am on 29th January for my first Ask Me Anything session of 2021, for a deep dive into the current trends.

Malachy O’Connor

Retail Industry Consultant & Director at Food First Consulting www.foodfirstconsulting.ie

Partner at International Private Label Consult www.iplc-europe.com

Partner at Uspire Ltd. www.uspire.co.uk